Do you Trade Futures? Make Markets?

Make more money. Trade better prices & volume than you can see on the exchange

Implied Execution Management System (EMS)

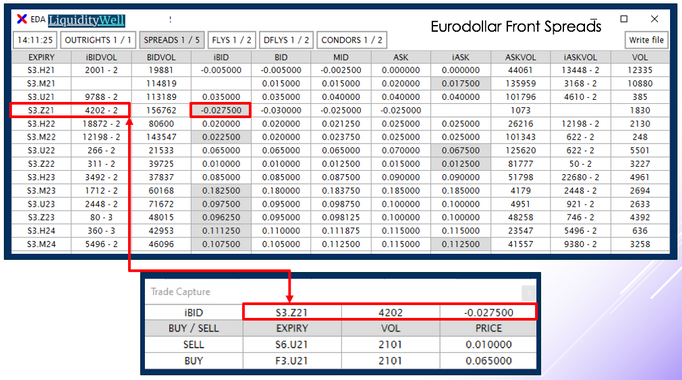

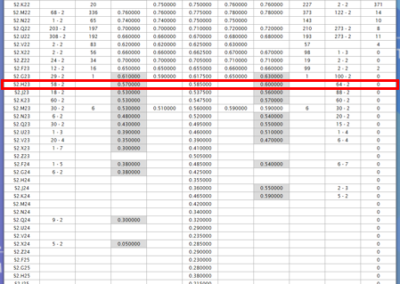

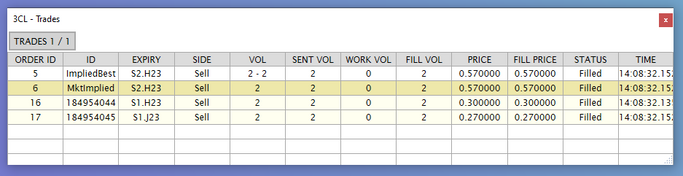

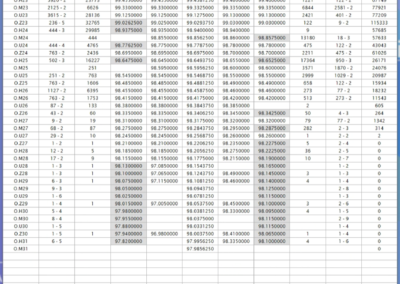

Simply put, trade on better prices and benefit from more liquidity than you see quoted on the exchanges.

LW provide Implied futures execution across all listed markets (STIRS, Energies, Commodities, Metals, Softs & Ags)

Execute via our Click & Trade user interface or via our internal API

Access

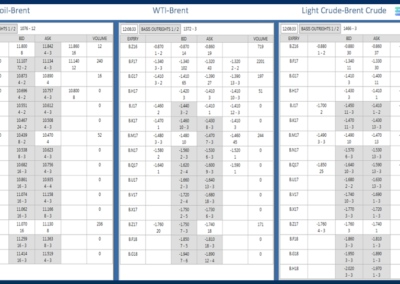

Single exchange (Eg Eurodollars) , Cross exchange (eg Brent Crude) and Cross product (eg Crack Spreads)

Integration – Seamless integration to your current access into the market, be that an off-the-shelf ISV or internal direct connection.

All risk and position limits flow through your current channels.

Implied Execution Management System (EMS)

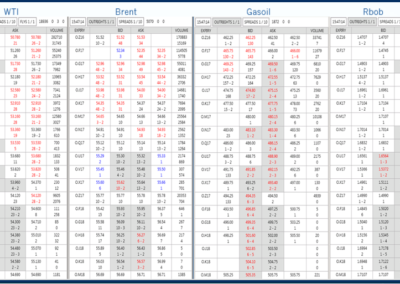

1. Below you can see the Crude Oil market. The LW iBID and iASK columns show added liquidity and improved pricing – even when the exchange has no prices at all. (Note the trueMIDS persisting throughout)

Our Office

Address: 86 - 90 Paul Street, 3rd Floor, London. United Kingdom. 3rd Floor, EC2A 4NE

Contact Us

+44 (0) 333 011 3665

info@liquiditywell.com

Office Hours

Mon-Fri: 9am - 5pm

Sat-Sun: Closed