What is Implication?

Implication Explained: Implication is the creation of better prices and additional volume by taking existing “explicit” orders and combining them together to generate better “implied” prices and volumes. Exchanges offer an element of this to some degree but often only to the first or maybe the second level.

They cannot do any more than this as they are not quick enough to complete the dynamically changing calculations that are required. Our software is quick enough and able to calculate universal implication across all the available market strategies (outright, spreads, butterflies, double flies, and condors)

LW creates most price improvements by trading an average of 2.4 trades (most price improvements are created by just asking for one extra trade) The cost of an extra leg is always materially beneficial to the trader in terms of additional PnL saved or generated.

Implied Trade Example

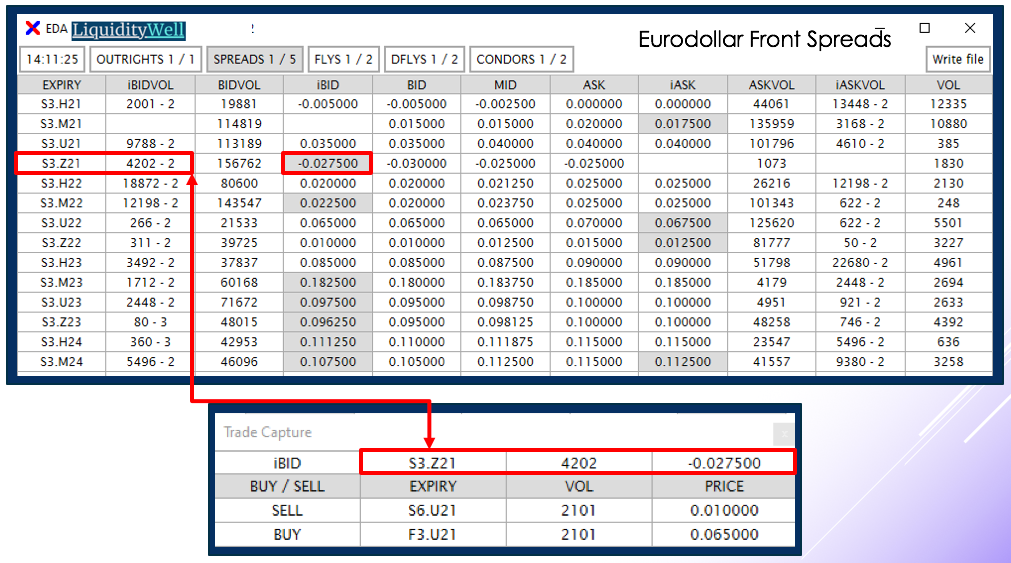

Header Key to the screenshots below

Normal Exchange Provided Information

Expiry: Expiry String eg S3.Z21 = Spread 3month out of Z21 ie Z21-H22 VOL: Total exchange volume traded

BID: Exchange BID BIDVOL: Exchange BID Vol ASK: Exchange ASK (offer) ASKVOL: Exchange ASK Vol

New LW Provided Information (Grey = Price better than exchange, White = Additional Volume)

MID: Liquidity Well proprietary calculated trueMID

iBID: LW implied BID iBIDVOL: LW implied BID Vol iBIDVOLlegs: # of trades to create the implied price

iASK: LW implied ASK(offer) iASKVOL: LW implied ASK Vol iASKVOLlegs: # of trades to create the implied price

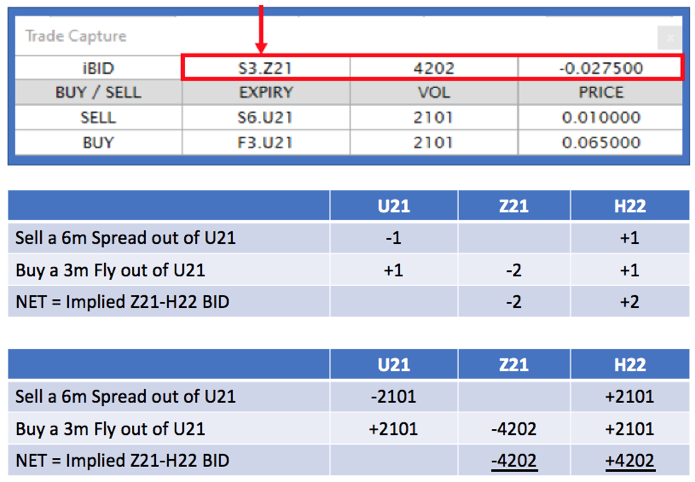

For the S3.Z21 Spread above, LW executable price is -0.0275. The Exchange best bid is -0.03. LW has 4202 lots available at this half tick better price.

$27,512 extra in the P&L for trading one additional trade/leg, as shown below.

Our Office

Address: 86 - 90 Paul Street, 3rd Floor, London. United Kingdom. 3rd Floor, EC2A 4NE

Contact Us

+44 (0) 333 011 3665

info@liquiditywell.com

Office Hours

Mon-Fri: 9am - 5pm

Sat-Sun: Closed